Florália Hematite Iron Ore Project

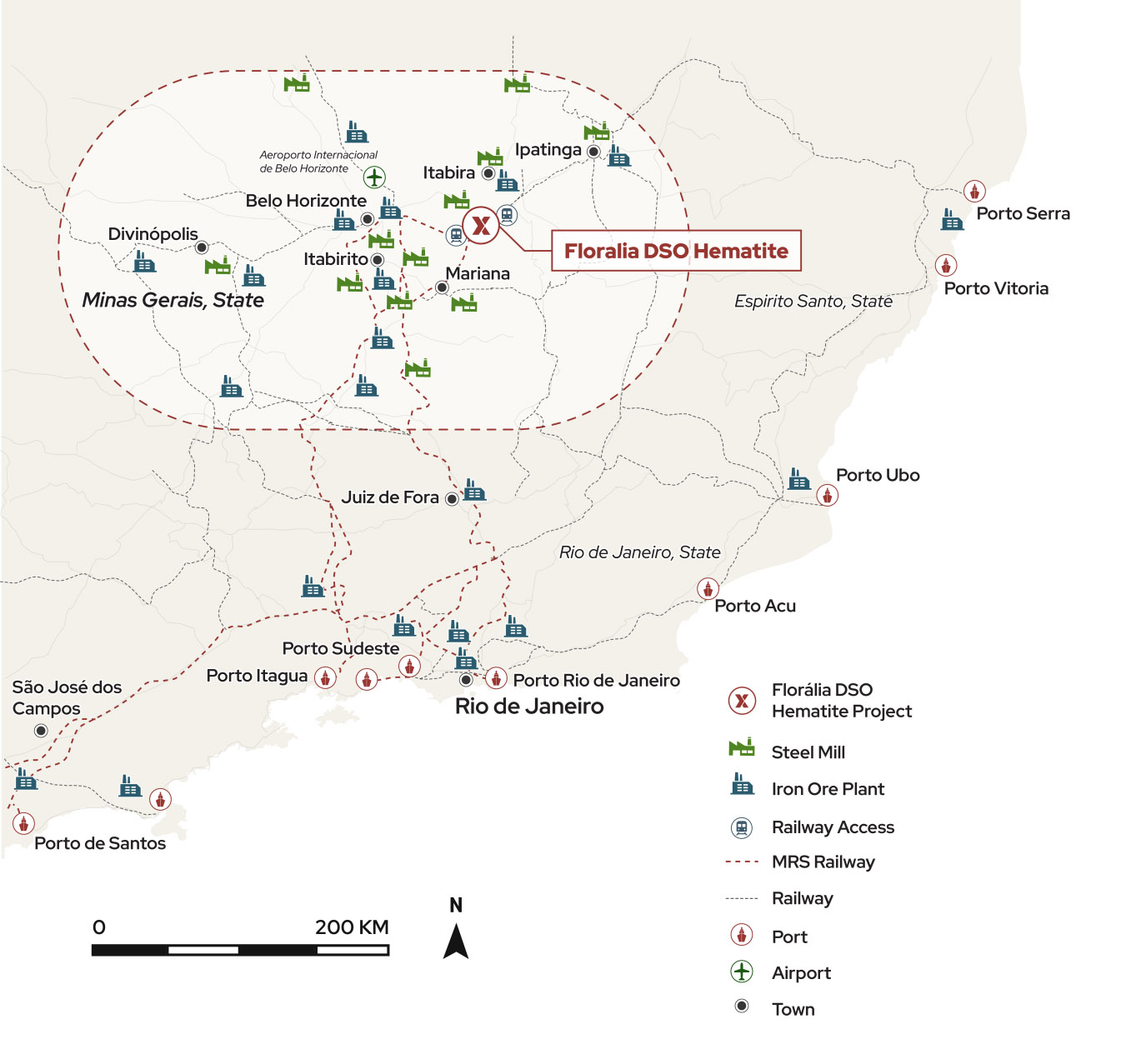

Located in Minas Gerais, Brazil’s largest iron ore and steel producing State and actively promotes mining investment.

Unlocking Brazil’s Iron Ore Potential

A Premier High-Grade Hematite Iron Ore Asset

The Florália Hematite Iron Ore Property is TAC Minerals’ flagship asset. Located in an established mining region with superior logistics and access to global steel markets, Florália is a low-capex, high-return project that prioritizes efficiency and sustainability.

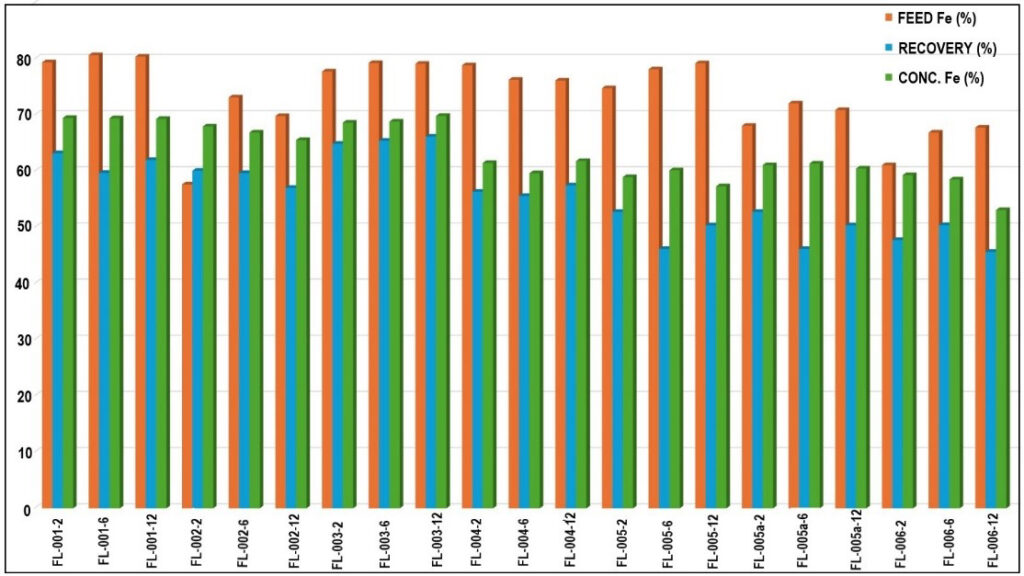

Exploration Target: 50 to 70Mt at 55-61% Fe1

- FL-001: 69.5% Fe at 81% recovery from 59.7%²

- FL-002: 66.9% Fe at 73% recovery from 59.7%²

- FL-003: 68.7% Fe at 78% recovery from 64.9%²

Our Vision

A Clean Energy & Lower Risk Pathway

TAC Minerals provides high-quality, sustainable iron ore that meets the evolving needs of the global steel industry while maintaining a commitment to efficiency, cost-effectiveness, and environmental responsibility.

Our hematite ore requires only crushing, screening, and dry magnetic separation, reducing costs and emissions.

Proximity to major steel mills ensures high demand and seamless distribution.

Dry processing eliminates water use, tailings dams, and significantly reduces our environmental footprint.

With first ore targeted within 24 months, we ensure swift market entry.

Overview & Infrastructure

A Smart Investment in Sustainable Iron Ore

- Project Location and Infrastructure – Located in the ‘Iron Quadrangle’ Minas Gerais, adjacent to existing infrastructure.

- Exploration Target 50 to 70 Mt at 55-61% Fe¹ – Dry magnetic test work increases Fe values between 8 to 28%² (lower grades correspond with greater increases).

- Accelerated Development Timeline – 1.5 Mtpa approval target of 2026 YE. Permitting and feasibility components underway.

- Low Capital and High Margin – High-grade ore, simple processing. Potential off-take funding.

- Optionality for Offtakes – Access to domestic and international markets via existing rail and proximity to major steel producers.

Achievements to Date

Completed Airborne Magnetic & LiDAR survey

Channel sampling of the historic Florália open and across banded iron formation, 131 of 174 returned values from 50 to 61% Fe. Maiden diamond and auger drilling initial results due shortly to confirm Exploration Target of 50 to 70mt at 55-61% Fe1

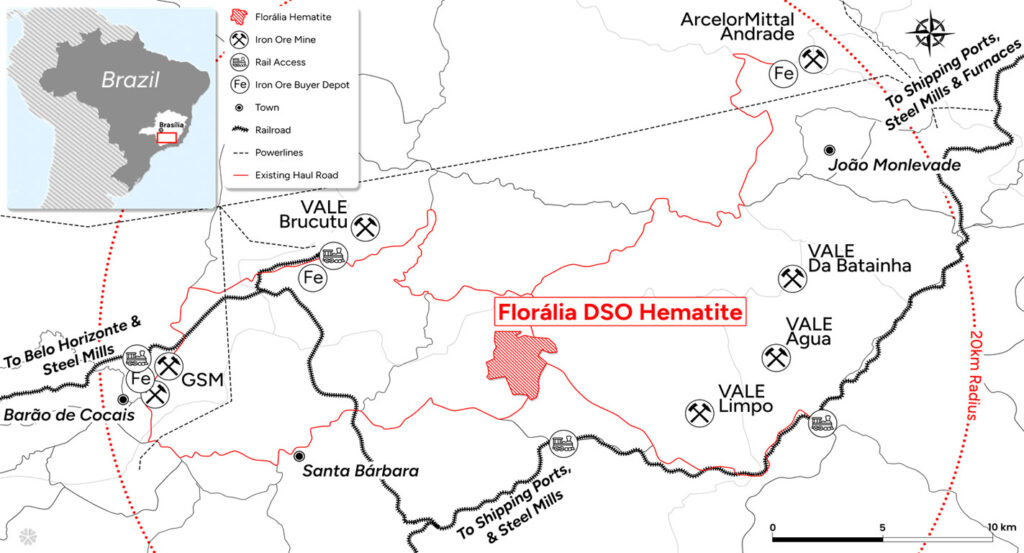

Logistics & Infrastructure Advantage

Florália has significant infrastructure advantage to sell domestically to local steel mills or into international seaborne market via existing roads to Vale (16 km), ArcelorMittal (26 km), rail terminal (15 km):

Historic Mine

Simple Dry Processing

Nearby Rail Networks

Iron Ore Ports

Haul Road to DSO Buyers

Rail to Steel Mills

Established neighbouring iron ore operations demonstrate low capital nature and expedited approval process.

Florália friable ore, free-dig, low-cost dry processing, by crush, screen and dry magnetic separation.

Access to DSO buyers;15 km road to rail on to steel mills and shipping ports;16 km road to Vale and ArcelorMittal (26 km).